On Friday, February 20, 2026, the U.S. Supreme Court ruled 6–3 that the International Emergency Economic Powers Act (IEEPA) does not authorize the President to unilaterally impose tariffs. The decision immediately invalidates most of the sweeping “reciprocal” and emergency tariffs implemented by the Trump administration over the past year.

In a new statement, Scott Lincicome, Vice President of General Economics and Cato’s Herbert A. Stiefel Center for Trade Policy Studies says:

“The court’s decision is welcome news for American importers, the United States economy, and the rule of law, but there’s much more work to be done. Most immediately, the federal government must refund the tens of billions of dollars in customs duties that it illegally collected from American companies pursuant to an “IEEPA tariff authority” it never actually had. That refund process could be easy, but it appears more likely that more litigation and paperwork will be required – a particularly unfair burden for smaller importers that lack the resources to litigate tariff refund claims yet never did anything wrong.

Even without IEEPA, other U.S. laws and the Trump administration’s repeated promises all but ensure that much higher tariffs will remain the norm, damaging the economy and foreign relations in the process. Implementing new tariff protection will take a little longer than it did in 2025 and, perhaps, will be a little more predictable. Overall, however, the tariff beatings will continue until Congress reclaims some of its constitutional authority over U.S. trade policy and checks the administration’s worst tariff impulses.”

The Court’s Ruling

- The Vote: Chief Justice John Roberts authored the majority opinion, joined by the court’s three liberal justices and conservative Justices Neil Gorsuch and Amy Coney Barrett. Justices Clarence Thomas, Samuel Alito, and Brett Kavanaugh dissented.

- Core Legal Argument: The Court found that while the 1977 IEEPA grants the President broad authority to regulate international transactions during a national emergency, it does not explicitly grant the power to levy tariffs. Chief Justice Roberts noted that the Constitution assigns the power to impose taxes and duties exclusively to Congress, and any delegation of that power must be clear.

- “Major Questions” Doctrine: The majority emphasized that the President’s assertion of “extraordinary power” to impose unbounded tariffs of unlimited amount, duration, and scope would represent a “transformative expansion” of executive authority that lacks historical precedent.

Immediate Impact on Policies

The ruling specifically strikes down several major tariff categories imposed under IEEPA authority:

- “Reciprocal” Tariffs: Sweeping duties placed on nearly every U.S. trading partner to address trade deficits.

- Border-Related Tariffs: Levies on goods from Canada, China, and Mexico intended to pressure those nations to stop the flow of illegal drugs like fentanyl.

- Other Specific Duties: This includes “free speech” tariffs on Brazil and secondary tariffs on India.

Note: The decision does not affect all tariffs. Levies imposed under different legal authorities—such as Section 232 national security investigations for steel and aluminum—remain in place for now.

Economic and Fiscal Consequences

- Billions in Refunds: Importers have already paid an estimated $130 billion to $200 billion in these now-invalidated tariffs. While the Supreme Court did not provide a specific mechanism for refunds, companies are expected to aggressively pursue them through the Court of International Trade.

- Budget Impact: The loss of this revenue—which the administration used to finance recent tax cuts—is expected to create a significant hole in the federal budget.

- Market Reaction: U.S. stocks rallied immediately following the news, with the S&P 500 jumping 0.5% and the Nasdaq soaring 0.6%.

- Consumer Savings: Analysts estimate that overturning these tariffs could save the average American household roughly $800 to $1,750 per year by reducing the price of imported goods.

The Administration’s Response

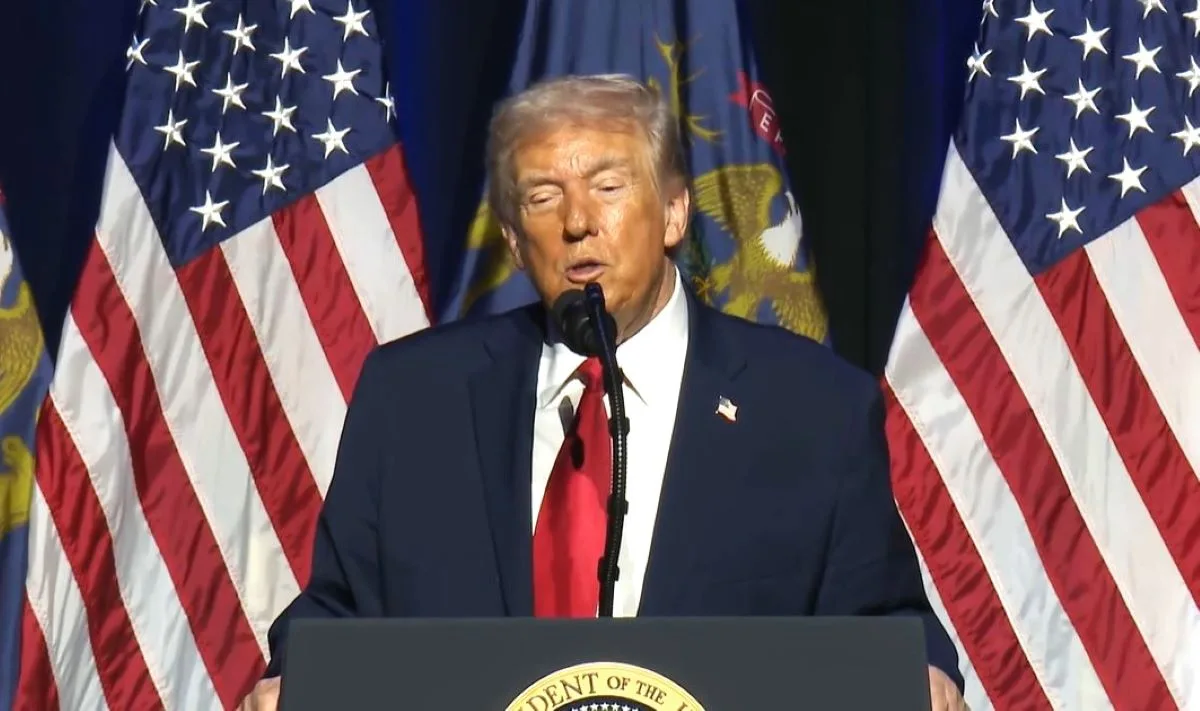

President Trump reportedly called the ruling a “disgrace” but stated he has a “backup plan.” The administration may attempt to reimpose some of these tariffs using other statutory authorities, though experts warn this will lead to months of additional legal uncertainty and potential new court challenges.

How this will Affect American Consumers

For the average American consumer, this ruling is essentially a massive, indirect tax cut. Since tariffs are taxes paid by U.S. importers (and usually passed straight to you), removing them should lower the cost of living.

Here is how this specifically hits your wallet:

1. Lower Prices on Everyday Goods

Economists estimate these “emergency” tariffs were costing the average household between $800 and $1,750 per year. You should start seeing price relief on:

- Groceries: Lower costs for produce and packaged goods from Mexico and Canada.

- Electronics & Toys: Significant price drops for items imported from China.

- Clothing & Furniture: Reduced “landed costs” for retailers like Walmart, Target, and Amazon.

2. Cooling Inflation

Tariffs are “inflationary” by nature. By striking them down, the Supreme Court has removed a major upward pressure on the Consumer Price Index (CPI). This could give the Federal Reserve more room to lower interest rates sooner, potentially making mortgages and car loans cheaper.

3. More Choice and Availability

Many specialty importers stopped bringing in certain goods because the 25%–100% tariffs made them “unsellable” in the U.S. market. You can expect to see:

- Return of Niche Products: European cheeses, specific Japanese electronics, and Mexican building materials that disappeared from shelves.

- Fewer “Out of Stock” Notices: Lowering the barrier to entry for importers helps stabilize the supply chain.

4. The “Refund” Effect

While you won’t get a check in the mail directly from the government, companies that paid billions in these tariffs are now eligible for refunds.

- Retailer Competition: In a competitive market, big-box retailers may use these windfall refunds to fund aggressive sales and discounts to win back customers.

- Stock Market Boost: Many consumer-facing companies saw their stock prices jump 0.5% to 0.6% immediately after the ruling, which benefits anyone with a 401(k) or IRA.

5. Potential “Snapback” Risks

It’s not all sunshine—there are two things to watch out for:

- The “Wait and See” Delay: Retailers rarely drop prices overnight. They will likely sell through their current “high-tariff” inventory before lowering prices on new shipments.

- Administration Workarounds: The President has already called the ruling a “disgrace” and hinted at a “backup plan.” If the administration finds a different legal loophole to reimpose the taxes, these consumer savings could be short-lived.