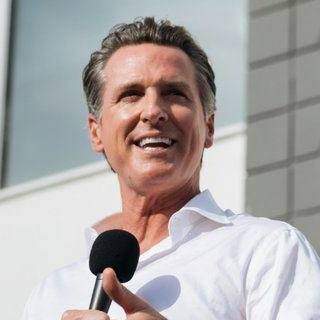

SACRAMENTO — Today, Governor Gavin Newsom unveiled another component of his $100 billion California Comeback Plan: making historic investments in small business relief. Governor Newsom’s Plan expands the state’s COVID-19 Small Business Relief Grant program to a total of $4 billion, representing the largest such program in the entire country. That’s in addition to Governor Newsom’s $6.2 billion tax cut for those businesses hit hardest by the pandemic, the largest state tax cut of its kind in history.

“Our small businesses have faced unprecedented challenges over the past year, and we’re stepping up to meet the moment – making historic investments to provide businesses with the support they need and jumpstarting California’s economic recovery,” said Governor Newsom. “That’s why we’re implementing the largest small business relief program in the entire country, expanding the small business grant program to $4 billion and providing $6.2 billion in small business tax relief. This is money in the pockets of business owners to make payroll and cover the bills as we prepare to fully reopen California’s economy on June 15.”

These grants are already supporting diverse small businesses throughout California, with 88.3 percent of grants in rounds one and two going to minority/people of color-owned businesses, women-owned businesses, veteran-owned businesses and businesses located in low to moderate income communities. To date, approximately 198,000 small businesses and nonprofits either have been or will be awarded grants, which includes finalized awards for 43,874 small businesses and nonprofits representing all 58 California counties for a total of $475,001,244. By expanding this successful program, we can ensure that even more small businesses can access this critical lifeline as we head toward full reopening on June 15.

In addition to these historic programs, Governor Newsom has taken swift action to invest in those sectors of the economy that are crucial to California’s recovery, including:

- Estimated $895 million investment in the State Small Business Credit Initiative (SSBCI), which works to strengthen state programs that support financing of small businesses.

- Increasing the CalCompetes tax credit program to $360 million, and establishing a one-time $250 million grant program, to incentivize businesses to relocate to California.

- $250 million investment in California’s ports to address revenue loss and bolster future economic activity.

- $200 million to expand sales tax exclusions through the California Alternative Energy and Advanced Transportation Financing Authority (CAEATFA) to promote, grow and incentivize green manufacturing in California.

- $147 million for the Main Street Small Business Tax Credit to assist small businesses that have hired and retained workers since the second quarter of 2020.

- $95 million to jumpstart California’s tourism industry, one of the largest economic drivers in the state that was particularly impacted by the pandemic.