SANTA ANA, Calif. – The owner of a Fullerton-based automotive repair business in pleaded guilty today to filing false tax returns for tax years for tax years 2015 to 2022, underreporting his income by at least

$1,184,914.

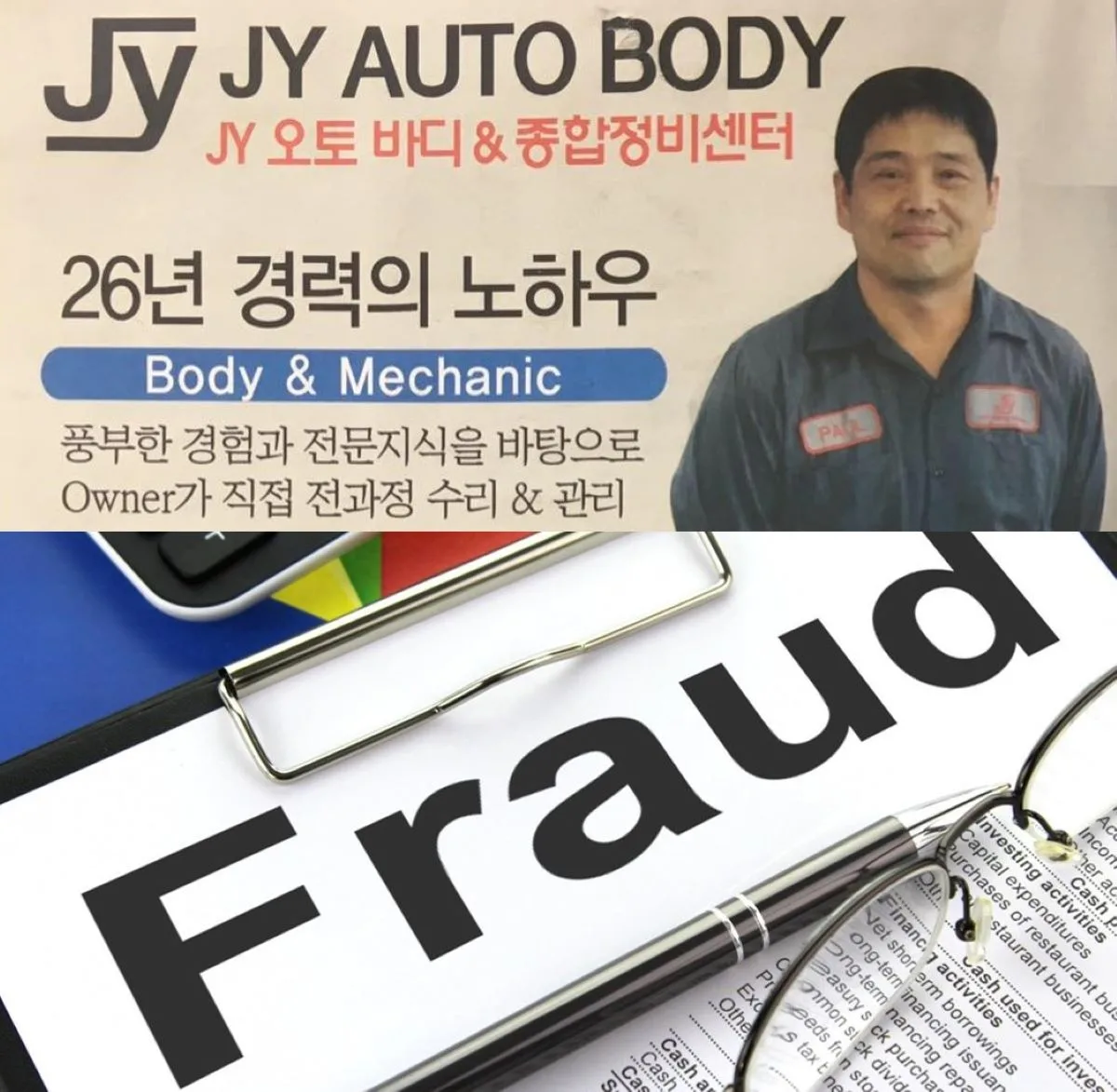

In Chun Jung, 57, of Anaheim, owned and operated JY JBMT INC., doing business as JY Auto Body, which was registered as a subchapter S corporation. S corporations elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Shareholders of S corporations report the flow-through income and losses on their personal tax returns and are assessed taxes at their individual income tax rates. Jung was the 100% shareholder of JY BMT INC.

According to his plea agreement, to conceal his income during the tax years 2015 to 2022, Jung accepted check payments from customers to JY BMT INC. for services, which he and his co-schemers then cash at multiple check cashing services located in Garden Grove. The cashed checks totaled approximately $1,157,462. Jung willfully and intentionally withheld the business receipts and income from checks cashed through check cashing services from his tax return preparer and, in doing so, willfully and intentionally omitted these receipts and income on his tax returns.

“Through his actions, Mr. Jung essentially stole from every American taxpayer,” said Special Agent in Charge Tyler Hatcher, IRS Criminal Investigation, Los Angeles Field Office. “His purposeful evasion of his tax obligation demonstrated selfishness and disregard for hardworking people across the United States. Tax crimes hurt everyone, and we will aggressively pursue criminal tax evaders.”

As part of his plea agreement, Jung will pay $300,145 in due taxes to the IRS, and faces a $250,000 penalty and up to three years in federal prison. United States District Judge John W. Holcomb scheduled a Jan. 31, 2025, sentencing hearing.

Assistant United States Attorney Kristin Spencer from the United States Attorney’s Office’s Orange County Office is prosecuting this case.

IRS-CI is the criminal investigative arm of the IRS, responsible for conducting financial crime investigations, including tax fraud, narcotics trafficking, money laundering, public corruption, healthcare fraud, identity theft and more. IRS-CI special agents are the only federal law enforcement agents with investigative jurisdiction over violations of the Internal Revenue Code, obtaining a more than a 90 percent federal conviction rate. The agency has 20 field offices located across the U.S. and 12 attache posts abroad.